TIME FOR "HOME BANKING"??? similar to HOME SCHOOLING, when institutions FAIL, it's UP TO YOU, COMRADES

Never Forget

UNDERSTAND THESE TWO POSTS ARE FROM JUST A FEW DUPLICITOUS BANKSTERS, IMO TRYING TO GET OUT FROM UNDER THEIR ENGINEERED COLLAPSE BY BLAMING THE FERAL RESERVE…… BANKSTERS HAVE THEIR UNIBANK LIKE THE POLITICIANS HAVE THEIR UNIPARTY. CYA IS THE NAME OF THEIR GAME…. THEY KNOW WHAT’S COMING BECAUSE THEY ARE BANKSTERS AFTERALL

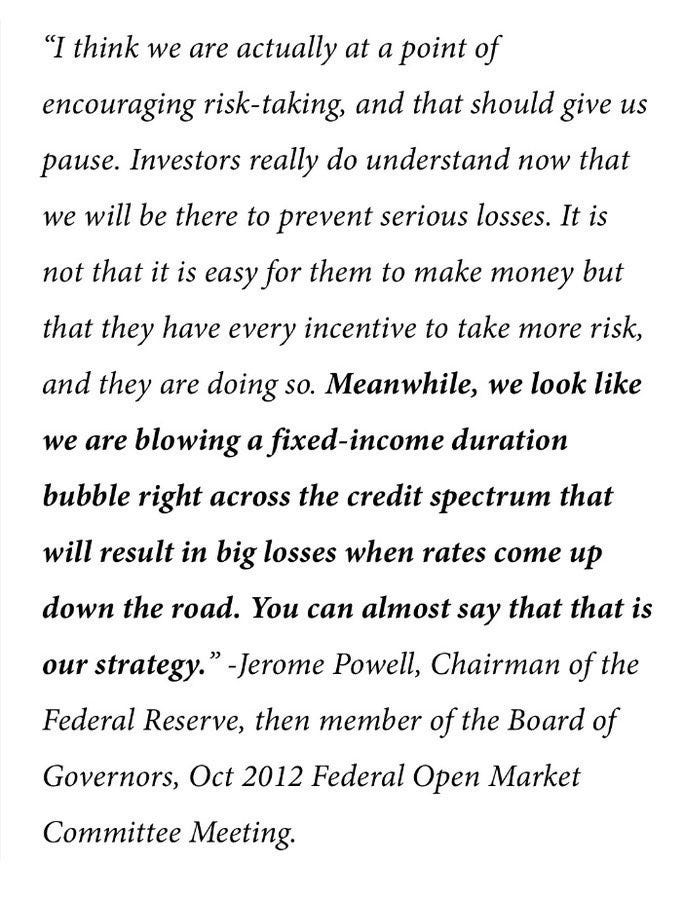

JPMorgan Chase Warns US Is ‘Past the Point of No Return’

“The Fed is facing a difficult task on Wednesday, but it is likely already past the point of no return,” JPMorgan’s strategists wrote in a note to clients this week, according to news outlets. “A soft landing now looks unlikely, with the airplane in a tailspin (lack of market confidence) and engines about to turn off (bank lending).”

“Even if central bankers successfully contain contagion, credit conditions look set to tighten more rapidly because of pressure from both markets and regulators,”

“while the banking crisis raises the prospect of recession this year as credit is restricted,” JPMorgan’s strategists added.

Fed Made ‘2 Big Mistakes:’ Top Economist Warns ‘We Risk a Very High Probability of a Damaging Recession’

Allianz chief economic adviser and noted economist Mohamed El-Erian has criticized the U.S. Federal Reserve, saying the central bank made “two big mistakes that may go down in the history books.”

What Happened

“One is mischaracterizing inflation as transitory. By that, they meant it is temporary, it’s reversible, don’t worry about it. That was mistake number one. And then mistake number two, when they finally recognized that inflation was persistent and high. They didn’t act in a meaningful way,” El-Erian told CBS News.

On Recession

The economist explained how the Fed’s actions create the risk of recession. “And as a result, we risk mistake number three, which is by not easing the foot off the accelerator last year, they are slamming on the brakes this year, which would tip us into recession,” he said.

The economist said the Fed has to not only overcome inflation but restore its credibility. “So, yes, I fear that we risk a very high probability of a damaging recession that was totally avoidable,” he said.

It’s Time To Talk About SVB’s (FTX’s) Ties To The World Economic Forum

After the implosion of the FTX crypto exchange run by Sam Bankman Fried, questions of due diligence and competency immediately arose, suggesting that perhaps the company mishandled assets “accidentally” and that Fried was naive and “in over his head.” Numerous central bank officials and globalist organizations jumped into the debate almost immediately, arguing that FTX was a perfect example of why centralized regulation of crypto and digital currencies was necessary. They claimed that without oversight by banking elites, disaster was inevitable.

Of course, what they did not mention was that FTX and Sam Fried already had extensive connections with globalist groups including the World Economic Forum. In fact, the very basis of Fried’s business model was the WEF’s “Stakeholder Capitalism” theory, which he often referred to as “Effective Altruism.”

U.S. Government Bails Out Elite Silicon Valley Venture Capital Ecosystem:

ALL democRAT DONORS??? BETS ANYONE??? KALYFOREIGNIA TO UKRAINE AWASH IN USA DOLLARS SOON TO BE USSA PESOS

Bank Failures Highlight Risks of Using ESG in Americans’ Pension Funds

President Joe Biden used his veto power on Monday to block a bipartisan action from Congress that would have prevented pension fund managers from investing retirees’ money according to environmental and social-justice criteria. (ESG)

However, despite attempts by its advocates to brand environmental, social, and governance (ESG) criteria as an effective risk-management tool, recent bank failures such as Silicon Valley Bank (SVB) suggest the opposite.

“If management is focusing on ESG, then important functions like risk-management can easily fall to the wayside,” Aharon Friedman, a former senior counsel to the House Ways and Means Committee and former senior advisor to the Treasury Department, told The Epoch Times. “ESG metrics are inherently subjective and unquantifiable, so using ESG factors to measure a company’s performance can hide bad management practices.”

First, if you don't know what a bank run is, it's when a bunch of people withdraw their money (or try to withdraw their money) from a bank at the same time because they think the bank is in trouble and might fail in the near future. Some of you have no doubt done this exact thing in the past month.

To understand how a bank run leads to a bank failure, it's important to understand how banks actually work.

When you deposit money in a bank — many people don't know this — they don't actually keep your money in the bank. They don't go stick all of it in a big vault in the back. They only really keep a small fraction of your money at all. They loan out and invest the it, and get a much higher rate of return than what they pay you. That's the main way banks make money. This is called fractional-reserve banking.

REQUIRED BANK FRACTIONAL RESERVE WAS 10% BUT HAS BEEN REDUCED TO 0%. ALSO YOUR DEPOSITS ARE “BANK ASSETS” NOT “YOUR” MONEY ANYMORE ONCE DEPOSITED.

ONLY 7% OF “MONEY” IS AVAILABLE IN PAPER. LET’S PLAY “MUSICAL CHAIRS”

HOME BANKING IS KEEPING PAPER DOLLARS AT HOME, USING CC FOR PRUDENT PURCHASES LEAVING ONLY MONTHLY RECURRING EXPENSE MONEY IN THE BANK. SETTLE UP ALL MONTHLY DEBTS MONTHLY.

SAVINGS ACCOUNT AT HOME IS SILVER/GOLD. LOWER DENOMINATION COINS FIRST FOR USE IF “PAPER” DOLLARS BECOME MORE WOTH LESS OR UNWANTED. LARGER COIN DENOMINATIONS FOR WEALTH SAVINGS.

OF COURSE “SECURITY” WILL BE REQUIRED. HIDDEN IS BEST, & NOT IN THE BEDROOM. A SAFE IS GOOD WHEN AWAY, BUT IN A HOME INVASION WHEN HOME NOT SO MUCH. HENCE YOU MUST BE ARMED (& TRAINED) WHILE HOME (OR AWAY).

THE NEW GAME IS RESPONSIBILITY. YOU ARE RESPONSIBLE NOT OTHERS, NOT BANKS, SCHOOLS, POLICE, etc. IT CAN BE LIBERATING TO EXPERIENCE LIBERTY WHICH IS JUST TOTAL RESPONSIBILITY FOR YOURSELF AND YOUR LOVED ONES.

THIS IS WHAT AMERICA NEEDS

Inside the Economic Reset

The central bank has been public enemy number one in America since 1791

Article 1, Section 10, Clause 1 of the Original US Constitution

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility”

A SHORT VIDEO OF YOUR LOSS OF LIBERTY, CYA gregreece.substack.com

BANKS “FAIL”, GET BAILED OUT OR REALLY “BAILED IN” BY YOU; BUT WHERE DO THE BANKSTER PIGGIES GO??? THOSE THAT CREATED THE BOOM-BUSTS ???

USUALLY LANDING IN ANOTHER FUTURE PIG STYLE BANKSTER SCAM …….

“WHY” THE EMPHASIS ON THE “ECONOMIC” ??? BECAUSE IT IS THE “LIT FUSE” TO THE “EXPLOSION”. THE ECONOMIC ISN’T THE EXPLOSION, MANY THINK IT IS, BUT THEY ARE WRONG. THE EXPLOSION IS MUCH WORSE AND WILL PIERCE YOUR VERY SOUL IN TERROR. “HOW” YOU HANDLE THIS FUTURE REALITY IS DEPENDENT ON THE ESSENTIAL PERSONAL INTEGRITY YOU MUST HAVE AND MAINTAIN THROUGHOUT.

So what's the solution for home banking? I say it's seed saving. Thanks for the memes and insightful article!

Those two “mistakes” by the FED were intentional.